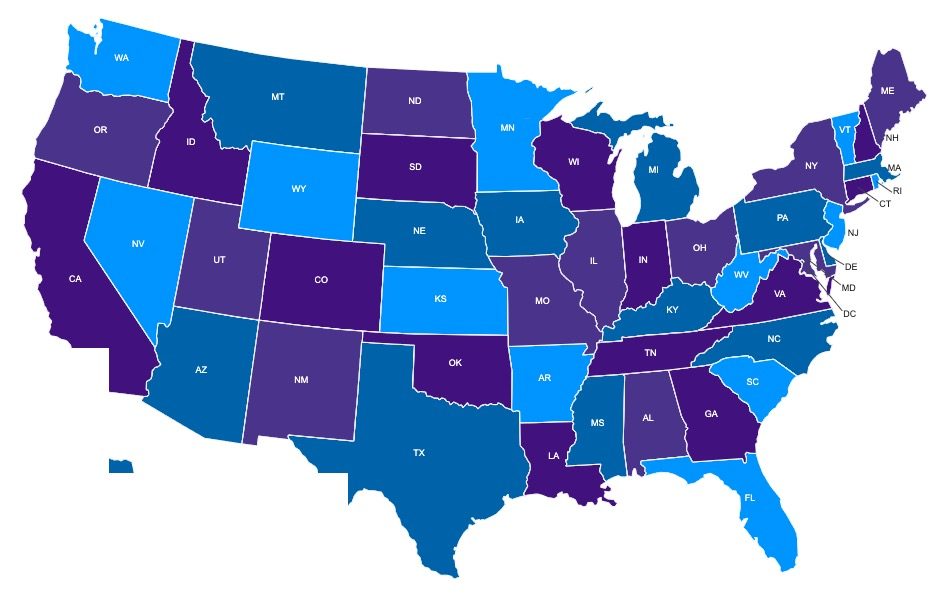

State Sales and Use Tax

List of State Sales and Use Tax Rate Tables

Sales and Use Tax Rate Tables:

-

Alabama State, County, City, & Municipal Tax Rate Table

-

Arizona State, County, City, & Municipal Tax Rate Table

-

Arkansas State, County, City, & Municipal Tax Rate Table

-

California State, County, City, & Municipal Tax Rate Table

-

Florida State, County, City, & Municipal Tax Rate Table

-

Georgia State, County, City, & Municipal Tax Rate Table

-

Idaho State, County, City, & Municipal Tax Rate Table

-

Illinois State, County, City, & Municipal Tax Rate Table

-

Indiana State, County, City, & Municipal Tax Rate Table

-

Iowa State, County, City, & Municipal Tax Rate Table

-

Kansas State, County, City, & Municipal Tax Rate Table

Ohio Sales & Use Tax

Sales Tax

The state of Ohio sales tax and use tax rate currently is at 5.75%. Local governments have the latitude to collect an optional local tax just as long as it does not exceed 2.25%. Within the states borders, there are about 555 local tax jurisdictions. Across the state the average local tax is about 1.403%, as well in conjunction with the state sales tax and the local tax the cities within the state of Ohio is 7.153%.

Sales and Use Tax License

Sales tax permits are mandatory for most businesses in Ohio. New businesses or if someone is initiating sales for the first time within the state of Ohio, then you will need to know and understand which business permit(s) (if any) are required. After submitting the application for a Ohio Vendor’s License, one could be ready to conduct business operations immediately.

Wisconsin Sales & Use Tax

Wisconsin Sales Tax

The state of Wisconsin sales tax is 5%. Local governments have the latitude to collect an optional local tax just as long as it does not to exceed 0.6%. Within the states borders, there are about 265 local tax jurisdictions. Across the state the average local tax is about 5.46%. In conjunction with the state sales tax and the local tax the cities of Wisconsin Dells and Lake Delton have the highest tax rate of 6.75% within the state.

Wisconsin Sales and Use Tax License

Sales tax permits are mandatory for most businesses in Wisconsin. New businesses or if it one is initiating sales for the first time within the state of Wisconsin, then you will need to know and understand which business permit(s) (if any) are required. After submitting the application for a Wisconsin Seller’s Permit, one could be ready to conduct business operations within 48 hours.

Florida Sales & Use Tax Application

Florida Sales Tax

The state of Florida sales tax is 6%. Local governments have the latitude to collect a local tax just as long as it does not to exceed 1.5% sales tax. Within the states borders, there are about 301 local tax jurisdictions. Across the state the average local tax is 1.011%. In conjunction with the state sales tax and the local tax the cities of Jacksonville, Kissimmee, Pensacola and Tampa and about 99 other cities have the highest tax rate of 7.5% within the state.

Sales and Use Tax License

Sales tax permits are mandatory for most businesses in Florida. New businesses or if someone is initiating sales for the first time within the state of Florida, then you will need to know and understand which business permit(s) (if any) are required. After submitting the application for a Florida Business Tax License, one could be ready to conduct business operations within 3 business days.

Resale Certificate

There is a requirement in the state of Florida for registration with the state in order to obtain a resale certificate. Applicant will receive their own resale certificate yearly after registering with the state of Florida.

Retailers wishing to make purchases with the purpose of resealing or execute transactions that is exempt from Florida sales tax, will need to obtain and have in their possession the necessary Florida sales tax exemption certificate before you are authorized to make tax-free purchases.

- Example Sales Tax Exemption Certificate

- Suggested Format Agricultural Blanket Exemption Certificate

- Suggested Format Blanket Exemption Certificate

- Resale Exemption Affidavit

Note: Uniform sales tax exemption certificates are also acceptable in Florida, this is a common or general certificate that maybe used across various states.

Minnesota Sales & Use Tax

Minnesota Sales & Use Tax

The state of Minnesota sales tax, is currently at 6.85%, as well some local governments also have applicable local sales tax up to 1.5% in addition to the state tax; making it the third highest state sales tax rate. The lowest tax rate in the state is 6.875%, while the highest tax rate is equivalent to 8.875%. Minnesota is said to have a relatively simple sales tax rate and a flat state tax rate. The state’s general funds makes up one part of the Minnesota tax and the arts and environmental soaks up the remainder of the taxes. As previously mentioned not only is there a state tax, additionally there are local and county taxes. Another variable is calculating the tax is the jurisdiction or county you reside in (see table above).

The sales tax rate is determined by the location of the purchaser or buyer at the conclusion of the sale or transaction; which makes Minnesota a destination-based sales tax state. For instance, with the advent of the internet, purchases made via the internet or mail within the state (both the buyer and vendor); the vendor has the responsibility of collecting all applicable taxes (state and local taxes). NOTE: taxes will vary somewhat again dependent on county.

With the state making continuous and important steps to simplify the state’s sales tax rules and administration process classifies Minnesota as a member of the Streamlined Sales and Use Tax Agreement.

Taxable Items

Minnesota as do the majority of the other states have similar definitions of what is taxable and what is not and the states while some things maybe alike there are a lot of things that are not. Simply put, Minnesota legally requires any/all tangible physical goods to be assessed a sales tax that is being sold to a customer. A few exceptions include but is not limited to baby products, clothing as well as over the counter medication.

For the most part services in Minnesota are not really viewed as taxable, most services are exempt from tax but there are some exceptions.

Relatively straight forward and very simple as it pertains to sales tax application to shipping and handling. If the item being shipped is considered taxable then shipping and handling tax will be applied but on the other hand if the item being shipped is not taxable then there will be no sales tax applied for shipping and handling. For shipments containing both taxable and non-taxable items, a portion of the shipment will incur shipping and handling tax according to the weight of the taxable item.

Lastly, as it pertains to whether or not drop shipments being subject to sales tax; the state of Minnesota usually does apply state sales taxes to drop shipments.

North Carolina Sales & Use Tax

Sales Tax

The state of North Carolina sales tax is 4.75%. Local governments have the latitude to collect a local tax just as long as it does not to exceed 2.75% sales tax. Within the states borders, there are about 324 local tax jurisdictions. Across the state the average local tax is 2.188%. In conjunction with the state sales tax and the local tax the cities of Chapel Hill, Durham, Hillsborough along with five other cities have the highest tax rate of 7.5% within the state.

Sales and Use Tax License

Sales tax permits are mandatory for most businesses in North Carolina. New businesses or if someone is initiating sales for the first time within the state of North Carolina, then you will need to know and understand which business permit(s) (if any) are required. After submitting the application for a North Carolina Sales and Use Tax Account ID, one could be ready to conduct business operations instantly.

Note: A business is regarded as having established sales tax nexus within the state of North Carolina is considered as having a taxable presence within the state.