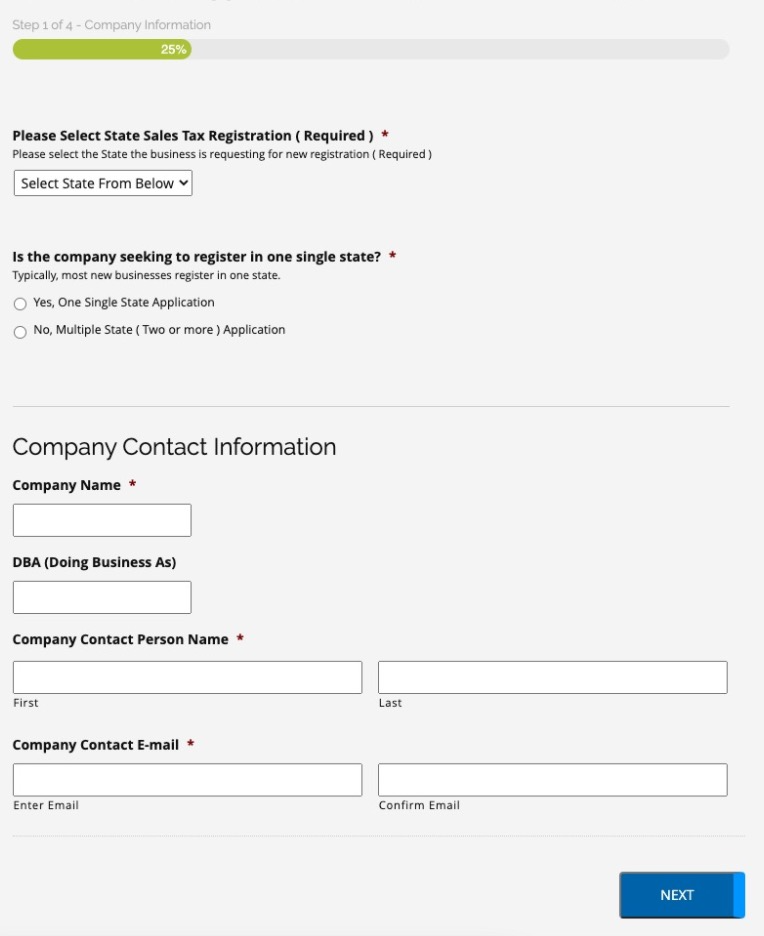

Almost any business that sells goods or taxable services within the State of New Jersey to customers located in New Jersey is required to report and / or collect sales tax from that buyer.

Registering for a nj state tax resale certificate is a near must for most all businesses reporting any taxable sales, even if the sales are zero dollars in revenue ( please consult with your accountant / tax advisor for further information ) .

In most cases, this will include all online businesses such as online sellers who sell through a website, or on Amazon, eBay, etc.

Any seller which conducts business and has a major presence within the state must collect sales tax in New Jersey must pay taxes to the state.

Therefore, these sellers required to file for a NJ State Tax Resale Certificate.

By not doing so, business may face sanctions or other types of penalties.

Additionally, depending on the businesses location in New Jersey and NJ tax jurisdiction, localities such as counties, cities, and other districts can also add additional sales and use taxes.

Please note each business is unique and may have different requirements.

Why do I need a frequently asked questions – to purchase wholesale items for resale in the State of New Jersey?

As a wholesale company conducting business in the state of New Jersey, you are required to have a nj state tax resale certificate when purchasing items at wholesale prices, Therefore, suppliers must request a copy of your nj state tax resale certificate before selling you items at State of New Jersey wholesale prices.

Do you have to collect NJ Sales Taxes from buyers who live outside New Jersey?

While you may not collect nj sales taxes from your out of state customers, you are still required to collect their information and report it to the State of New Jersey.

Do you need to collect sales nj tax on shipping and handling of merchandise?

If you sell tangible goods in New Jersey that are taxable than you would charge nj sales tax on shipping and handling charges.

Is there nj sales tax on drop shipments in the State of New Jersey?

A drop shipment is where a seller (most times out of state) sells a product which is then delivered to a consumer by a third party shipper. In most instances, drop shipments in New Jersey are required to have sales tax added

Are there any exemptions to taxable items sold?

Leases on motor vehicles, safety apparel, certain medical goods and equipment, groceries, raw materials and machinery, newspapers, and general pollution control equipment are tax exempt

Do you need to get a Sales Tax certificate in the State of new-jersey?

You may need a Sales Tax Certificate if any of the following apply your business:

- You have a physical office or place you conduct

- You sell or ship products to a buyer in new-jersey

- You have a distribution location such as a storage area or warehouse space

- You have employees physically present in new-jersey

- You have changed your business structure or moved to a new location

- Your business purchases wholesale items for resale in the state of new-jersey

- Your business provides taxable services within the state of new-jersey

What constitutes taxable services in new-jersey State?

- Commercial real property remodeling and repair

- Construction companies that charge for materials

- Credit Repair and reporting type services

- Data processing services

- Debt collection agencies

- Internet or information provider services

- Labor that is taxable (usually labor used in the production of tangible goods)

- Personal accommodation services

- Residential real property services

- Recreational amusement services

- Satellite and Cable television providers

- Security providers

- Telecommunications providers and similar services

- Telephone answering services

- Transmission and distribution services for utilities

- Vehicle parking and storage facilities

nj state tax resale certificate – common site searches

Common Application requests to apply for nj state tax resale certificate :

Sales Tax Application new-jersey

Application for sales tax exempt new-jersey

new-jersey Sales Tax Permit application

new-jersey Sales tax Registration application